The Rule of 40 is a significant financial metric for Software as a Service (SaaS) companies. It states that a company’s growth rate combined with its profit margin should equal or exceed 40%.

Achieving this benchmark is relatively rare. Only about one-third of software companies manage to meet the Rule of 40, and even fewer can sustain it over time, according to McKinsey research. This metric serves as a quick snapshot of a company’s performance and helps investors and stakeholders assess its viability and long-term success.

Why Is The Rule Of 40 Important?

- Investor confidence: Investors often look for companies that meet or exceed the Rule of 40 because it indicates a balanced approach to growth and profitability.

- Sustainability: Companies that adhere to this rule are more likely to sustain their growth over time and avoid cash flow issues.

- Benchmarking: The Rule of 40 provides a benchmark for SaaS companies to measure their performance against industry standards.

How To Calculate The Rule Of 40

Calculating the Rule of 40 is straightforward and involves knowing or calculating two key metrics: growth rate and profitability.

Once you have these two metrics, you can determine if a company meets the Rule of 40 by adding the growth rate to the profitability metric. If the combined total is greater than or equal to 40, the company is considered to meet the Rule of 40.

Basic Calculation: SaaS Growth Rate (%) + SaaS Profit Margin (%) ≥ 40

However, it is more nuanced than that, as the exact calculation depends on how you measure growth and profitability.

Steps To Calculate The Rule Of 40

Step 1: Calculate Growth Rate

For growth rate, companies typically use total revenue or Annual Recurring Revenue (ARR) as the base metric. The growth rate is usually calculated as the year-over-year percentage increase.

Growth Rate = ((Current Year ARR – Previous Year ARR) / Previous ARR) × 100

Example Growth Rate Calculation: BlitzScale AI

BlitzScale AI ARR Growth Rate = (($1.2M – $1M) / $1M) × 100 = 20%

Step 2: Calculate Profitability

For profitability, the most common metric is the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin, but free cash flow is also used. In the formula and example below, we use EBITDA margin as a stand-in for profitability.

EBITDA Margin = (EBITDA / Revenue) × 100

Example EBITDA Margin Calculation: BlitzScale AI

EBITDA Margin = ($300,000 / $1,200,000) × 100 = 25%

Step 3: Add The Two Metrics Together

As the final step, add the company’s revenue growth rate and EBITDA margin together. If the total is 40% or higher, the company meets the Rule of 40 benchmark. In the formula and example below, we use ARR.

Growth Rate (YoY ARR Growth) + Profitability (EBITDA Margin) ≥ 40

Final Rule Of 40 Calculation: BlitzScale AI

Rule of 40 Calculation = 20% + 25% = 45%

Result: 45% ≥ 40%

BlitzScale AI scores 45%, which exceeds the Rule of 40 threshold. This means BlitzScale qualifies as a Rule of 40 company.

Interpreting The Results

- Below 40%: This may indicate a need to focus on either growth or profitability, or both.

- Near or slightly above 40%: This suggests a healthy balance between growth and profitability, fast growth, or that the company is highly profitable. For example, if a company has low profitability but a high growth rate, it shows fast growth and success in expanding the business. On the other hand, if a company has flat or modest growth but high profitability, it signals strong operational efficiency. Each of these profiles will attract different types of investors.

- Well above 40%: A Rule of 40 score well above 40% indicates an exceptional company. This typically means the business is either growing rapidly while also becoming significantly more profitable or experiencing such massive growth that it outweighs flat or even negative profitability. These companies are well positioned to attract additional funding if privately held, or to draw in more investors if publicly traded, assuming the business environment remains favorable.

The Role Of The Rule Of 40 In SaaS Strategy

Understanding and applying the Rule of 40 can significantly shape a SaaS company’s strategy, particularly in how it allocates resources and positions itself with investors.

- Resource allocation: Companies using the Rule of 40 will prioritize investments in growth or profitability depending on how they currently measure against the benchmark.

- Investor positioning: Companies that consistently meet the Rule of 40 can present themselves as top-performing SaaS businesses and attract stronger investor interest.

Challenges With Achieving The Rule Of 40

Balancing growth and profitability is difficult, especially for SaaS companies that have focused on growth for years. Hitting the Rule of 40 often means making hard changes, and those shifts can be painful.

Cutting costs after a growth spree: Many SaaS companies build their culture and operations around aggressive growth. When the focus shifts to profitability, leaders may need to cut budgets, pause new projects, or reduce headcount. In some cases, the business model may need to change. That might mean targeting higher-margin customers, scaling back services, or simplifying the product. These changes can impact team morale and the customer experience.

The strain of aggressive growth: On the flip side, for companies trying to hit the Rule of 40 with growth as the main driver, the pressure to scale quickly can create problems. Without improving efficiency, growth often comes with rising acquisition costs, bloated teams, and a high burn rate. If growth slows, the lack of margin leaves little room to recover.

Best Practices For Implementing The Rule Of 40

Regular Monitoring And Reporting

Establish a consistent cadence for tracking Rule of 40 performance. Quarterly reviews are a common benchmark. Regular reporting helps leadership identify trends and make timely adjustments to improve growth, profitability, or both.

Integrating Other Metrics

To become a Rule of 40 company, all teams should track leading indicators that drive growth and profitability. For go-to-market teams, example metrics include pipeline growth, customer acquisition cost (CAC), customer lifetime value (LTV), and the LTV/CAC ratio. Tracking these metrics keeps teams focused and aligned with the goal of reaching Rule of 40 performance.

Setting Realistic Goals

Use the Rule of 40 to set performance targets that are both motivating and achievable. When setting goals, consider your current performance, market conditions, and growth potential. Realistic targets help manage expectations with key stakeholders and increase the likelihood of reaching your Rule of 40 benchmark.

Educate Stakeholders

Ensure both investors and employees understand the Rule of 40. Most investors will already be familiar with it, so communicating your focus helps manage expectations and reinforce alignment. Employees may need more context. Explain how the Rule of 40 balances growth and profitability, and why it matters to the company’s long-term success.

Gaining support from both groups is essential. Investors need confidence to stay committed, and employees need clarity to stay engaged, especially when cost-cutting measures are part of the strategy.

Case Study: Successful Implementation Of The Rule Of 40

Company: HubSpot

Background: HubSpot is a leading platform for inbound marketing, sales, and customer service, designed to help businesses grow by attracting visitors, engaging leads, and managing customer relationships. Best known for its customer relationship management (CRM) software, HubSpot competes directly with Salesforce in the CRM space.

Application Of The Rule Of 40:

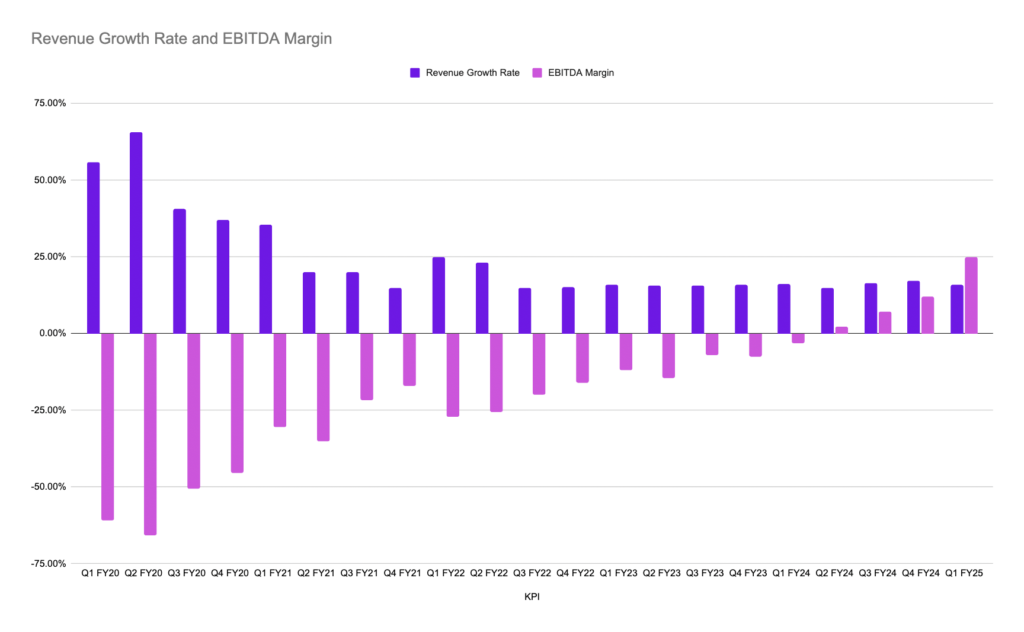

- Growth Rate: HubSpot’s latest twelve-month Rule of 40 score is 42.4% as of the writing of this article.

- Historical Performance: HubSpot’s average Rule of 40 score for the fiscal years 2020 through 2024 is 45.8%.

- Peak Performance: HubSpot’s Rule of 40 performance peaked in December 2021 at 63.4%.

- Lowest Performance: The Rule of 40 hit its 5-year low in December 2020 at 36.7%.

Outcome:

HubSpot’s ability to maintain a Rule of 40 score above 40% indicates a healthy balance between growth and profitability, making the company attractive to investors and positioning it for continued success in the SaaS market. HubSpot went public on October 9, 2014, with an IPO price of $25 per share. As of the writing of this article on March 21, 2025, HubSpot’s stock price is $606.27.

Final Thoughts On The Rule Of 40

The Rule of 40 is a simple yet powerful benchmark that helps SaaS companies balance growth and profitability. Achieving it can be challenging. It requires strong coordination across teams, clear visibility into key metrics, and the discipline to make hard decisions, especially in uncertain markets or during cost-cutting cycles.

But for companies that reach or exceed the Rule of 40, the benefits are real. It builds trust with boards and investors, strengthens long-term financial health, and sets the foundation for sustainable growth. In a competitive landscape, the Rule of 40 is more than a metric. It is a signal that your business is efficient, resilient, and built to scale.