SaaS Marketing Analytics helps software-as-a-service businesses track results, manage spending, and understand buyer behavior. It shows companies what works and what doesn’t. With these insights, SaaS comapines can make smarter decisions, improve the ROI of their marketing spend, drive new business, and increase enterprise value.

In this guide, we’ll explain marketing analytics for SaaS in detail. We’ll explore attribution models and discuss how to set KPIs. We’ll also review common mistakes, such as focusing too much on lead generation or not measuring sales and marketing efforts together. By the end, you’ll know why marketing analytics matters for SaaS businesses. You’ll also learn its benefits, challenges, use cases, and best practices for driving growth. Let’s dive in.

What Is Marketing Analytics?

Marketing analytics is the process of collecting and analyzing data to understand what marketing activities work and why.

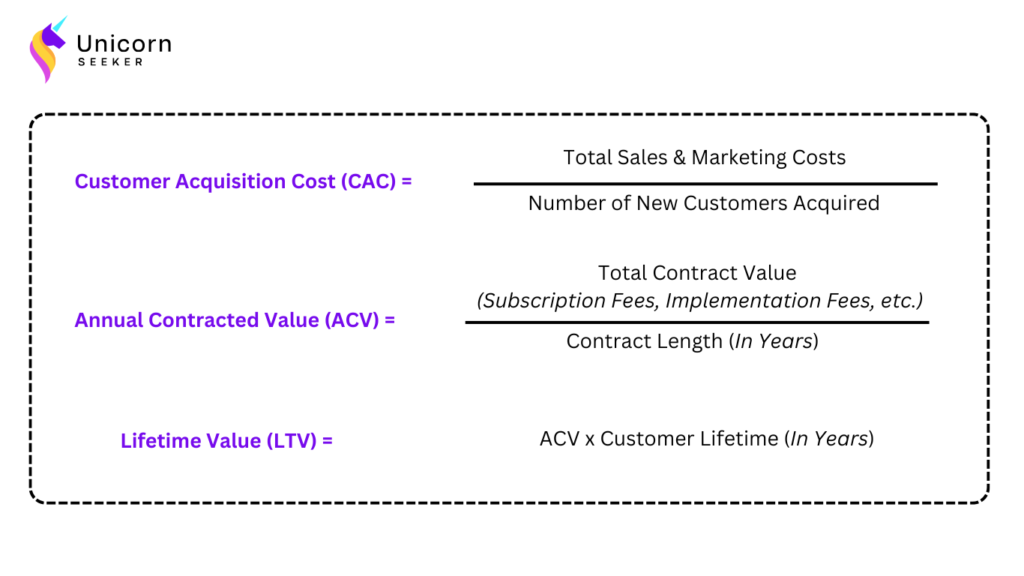

SaaS companies use it to evaluate and optimize their marketing initiatives. Common metrics in SaaS marketing analytics include customer acquisition cost (CAC), annual contract value (ACV), and customer lifetime value (LTV).

To guide decision-making, marketing analysts gather data from tools such as Google Analytics, customer relationship management (CRM) systems, email platforms, and ad networks.

With the right data, marketing analysts can identify which channels drive the most leads or deliver the best return on investment. Effective marketing analytics connects marketing efforts to business goals. It also helps companies optimize spending across channels like paid search, SEO, and social media.

Why Marketing Analytics Is Important For SaaS Companies

Marketing analytics is critical for helping SaaS marketing teams make better decisions. Without it, teams may not know which campaigns are effective. Budgets could be wasted on lower-performing channels. Strategies might rely on guesswork or assumptions instead of data, leading to poor results. Analytics is also essential for reporting performance to leadership.

Reports from marketing analytics show how marketing supports business goals, such as increasing sales pipeline or reducing the cost to acquire new clients. By relying on data instead of just assumptions, teams can allocate resources more effectively, drive growth, and deliver meaningful reports to leadership.

Marketing Analytics vs. Marketing Attribution

Marketing analytics and marketing attribution are closely related. Marketing analytics tracks and measures overall performance. It gives insights into ROI, audience behavior, and how well channels perform.

Marketing attribution, however, is a process that helps teams understand the impact of campaigns on specific outcomes, like increased sales pipeline or won deals. It assigns value to each marketing touchpoint—such as ads, emails, or webinars—and shows how much each interaction contributes to the final result.

Marketing Attribution Models

Marketing attribution models assign credit for conversion points, such as won deals, to various marketing touchpoints. Each model credits touchpoints differently. These models help businesses identify which interactions drive results and determine ROI.

Common attribution models:

- First-Touch Attribution: This model gives all credit to the first interaction that starts the buyer’s journey.

- Last-Touch Attribution: This model assigns all credit to the final interaction before a conversion.

- Multi-Touch Attribution: It spreads credit across every touchpoint in the buyer’s journey.

- Time Decay Attribution: This model gives more credit to touchpoints closer to the conversion.

- Data-Driven Attribution: This model uses machine learning to assign credit to each touchpoint based on its actual contribution to the conversion. It analyzes patterns across large datasets to determine how each interaction influences the buyer’s decision.

Attribution Tools

Attribution tools help marketing teams track how different touchpoints influence the buyer’s journey. These tools automate data collection and analysis, which saves time and improves accuracy. Below are some popular attribution tools for SaaS businesses:

- Marketo Measure (formerly Bizible): This tool helps B2B marketers link CRM data to multi-touch attribution. Marketo Measure is ideal for teams that use Marketo as their marketing automation platform.

- HubSpot: HubSpot’s attribution tools are built into its CRM and marketing platform. They are ideal for teams already using HubSpot to track and report customer interactions.

- Dreamdata: Tailored for B2B SaaS companies, Dreamdata connects revenue data to marketing and sales efforts, offering clearer insights into ROI.

- Factors.ai: This platform helps SaaS businesses analyze attribution data and improve campaign performance with actionable insights.

- Google Analytics: A free platform offering attribution models like last-click, first-click, and data-driven. It’s easy to use and widely available. However, a downside is that Google Analytics only shares anonymous insights, which means it doesn’t allow for understanding attribution at the account or individual level.

- Google Ads: Google Ads offers free tools to track conversions from paid search, video, Performance Max, DemandGen, and display campaigns. Similarly, a limitation is that it only provides anonymous insights, making it difficult to understand attribution at the account or individual level.

The Role Of Click Attribution In Marketing Attribution

Most marketing attribution software relies on click attribution. This click attribution assigns credit to a conversion based on direct interactions with media like ad clicks, email link clicks, or website visits.

Click attribution works well for measuring demand capture channels, such as paid search. These channels focus on capturing existing demand from prospective buyers who are already searching for a solution or are further along in their decision-making process.

However, click attribution has limits. It often under represents influences like word of mouth, podcasts, organic social media, or marketing channels that don’t drive direct website traffic. These channels are critical for demand generation, which creates new interest and drives long-term growth often through thought leadership. Teams that focus only on click-based metrics risk undervaluing efforts that build demand and overvaluing those that capture existing demand.To get a full picture, businesses should combine click attribution with other data sources, like customer surveys or self-reported attribution. This approach measures both demand generation and demand capture, leading to smarter investments.

Common Attribution Models Used In SaaS

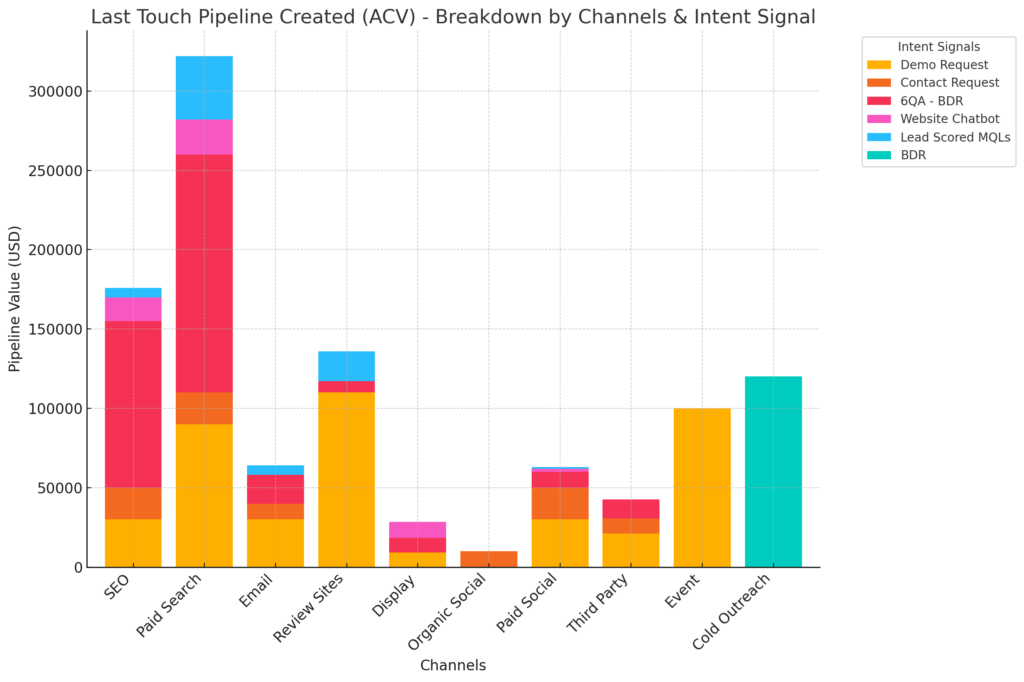

Last-touch attribution is one of the most commonly used attribution models in SaaS. It assigns all credit for a conversion to the final marketing or sales touchpoint before the conversion. It is popular because it is simple to understand, easy to explain, and doesn’t require adding a new tool to your tech stack. Marketers can implement it by setting up UTM parameters and performing an attribution analysis in spreadsheets.

This approach gives credit for a result to the final marketing touchpoint, such as clicking on a paid search ad and then requesting a demo. It’s useful for giving marketing teams insight into the final message or interaction that may have triggered someone to convert.

However, no attribution model or tool is perfect. Last-touch attribution ignores the value of earlier touchpoints, such as brand awareness campaigns or educational content. For businesses with longer sales cycles, relying solely on this model creates an incomplete picture of what drives conversions.

To gain better insights, companies should combine last-touch attribution with other models and self-reported attribution data. Attribution models and tools should be seen as a way to understand what’s driving business impact. Just as you need more than one tool to build a house, you need more than one attribution model to grow a company.

KPIs vs. Metrics

Attribution helps you understand what’s driving results, but you need to know what those right results are and how to improve them. This brings us to metrics and KPIs—two key concepts of marketing analytics.

- Metrics: Metrics are standalone numerical data points. For example, customer acquisition cost (CAC) for a given month is a metric.

- KPIs (Key Performance Indicators): KPIs link key metrics to specific business goals. For instance, using the CAC metric, a KPI could be reducing customer acquisition cost by 10% over the next quarter to improve profitability. In this case, the metric becomes a KPI, and progress can be measured monthly as a percentage of goal attainment.

How KPIs Have Traditionally Been Set In SaaS

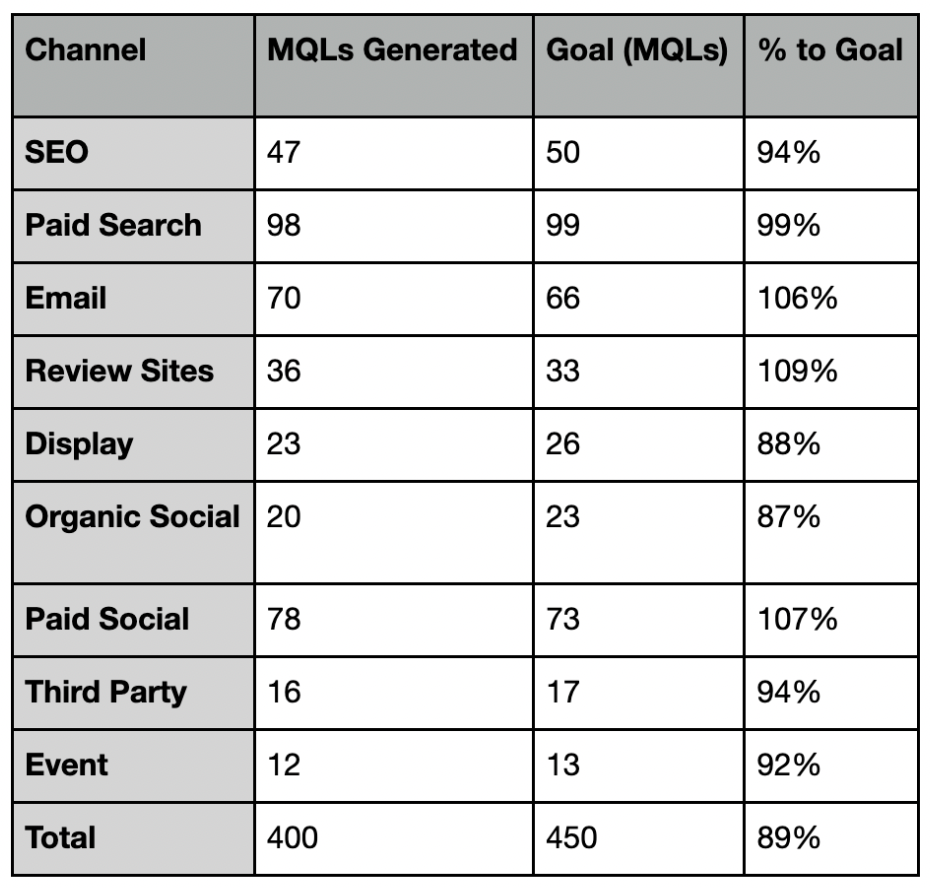

In SaaS, traditional KPI-setting typically emphasizes improving metrics such as the volume of Marketing Qualified Leads (MQLs).

Challenges with SaaS KPIs

Whether a SaaS company tracks MQLs or sales opportunities tied to MQLs, relying on either as the basis for KPIs can lead to significant challenges:

- Siloed Sales and Marketing Measurements: Traditional marketing KPIs don’t measure the combined impact of sales and marketing teams working together. Instead, these teams are often measured separately, forcing reliance on attribution models (often last touch) to justify each team’s contributions. This approach bleeds into how all of marketing evaluates performance across every channel, often creating a heavy focus on generating MQLs. It also sparks conflicts over attribution, as teams dissect what works and what doesn’t, rather than asking the bigger question: is the entire go-to-market engine effective?

- MQLs That Don’t Convert: Many SaaS companies use MQLs—often defined as demo or eBook requests—as their primary metric for linking marketing to revenue. However, these single-intent signals frequently fail to align with closed-won deals, leading to a disconnect between marketing efforts and revenue outcomes.

- Overemphasis on Demand Capture: Because of a focus on generating inbound leads, companies often invest heavily in demand capture channels like paid search or review platforms such as Gartner Digital Markets. This approach can lead to over-investment in these channels. Without creating new demand, these efforts frequently result in diminishing returns as goals surpass the available market demand.

- Limited Investment in Demand Generation: Top-of-funnel demand generation channels, such as brand awareness or educational content, often face budget cuts. This is especially common when companies rely on last-touch attribution models. Pulling back on demand generation reduces the total market demand over time. This creates a vicious cycle. With less demand created, there are fewer opportunities for demand capture, forcing more investment into lower-funnel channels like paid search. Over time, relying on shrinking market demand without shaping the market narrative through consistent demand generation leaves companies vulnerable to competition and stifles growth potential.

By relying on traditional SaaS KPIs, companies risk misaligned priorities, under-investment in demand generation, and over-reliance on existing market demand instead of creating new demand. A telltale sign of these issues is when marketing repeatedly misses its KPI goals—or achieves them while overall revenue from go-to-market teams declines.

Modern KPI-setting should measure the combined impact of sales and marketing. It should account for how these teams work together and balance demand capture with demand generation. In the next section, we’ll explore how KPIs should be set in 2025 to align with revenue goals and drive sustainable growth.

How KPIs Should Be Set In 2025

Measure The Full Impact Of Sales And Marketing

To drive growth in 2025, SaaS companies must adopt modern KPI strategies. These strategies should:

- Measure the full impact of sales and marketing together.

- Identify key actions or intent signals for sales outreach that drive pipeline growth, expanding beyond just MQLs to include deeper buyer intent and engagement indicators.

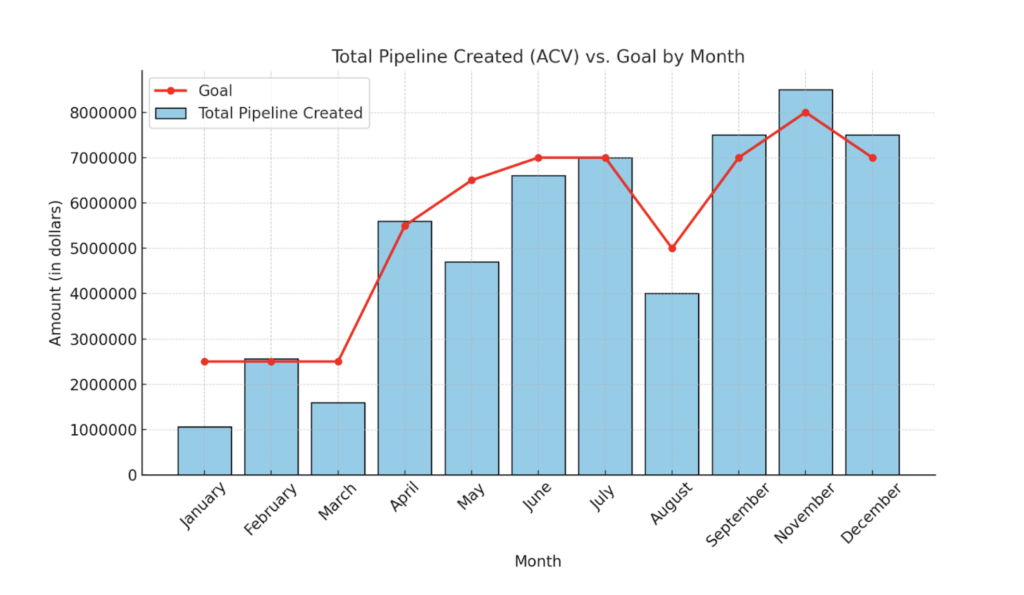

Instead of measuring sales and marketing performance separately, SaaS companies should focus on their combined impact. By setting unified KPIs, such as increasing pipeline ACV by a certain percentage or decreasing CAC by a defined margin, teams can work toward shared business outcomes.

This approach reduces friction caused by fragmented attribution models and ensures both sales and marketing are aligned with top-down business objectives.

Identify Key Intent Signals

Marketing analytics plays a crucial role in identifying intent signals that indicate prospects are ready to buy. Once those signals are defined, marketing teams can work with channel and platform experts to focus on marketing efforts that drive strong buying intent.

Examples of key signals to track:

- Demo Requests: Buyers requesting a demo that qualify as MQLs.

- Lead-Scored MQLs: Leads prioritized based on scoring models, such as multiple website visits or viewing the pricing page.

- 6sense Qualified Accounts (6QAs): High-intent accounts identified using predictive analytics, for companies using 6sense.

- Sales Follow-Up Requests from Website Chat Bots: Inquiries initiated through chat bot interactions.

Marketing analytics should also work with attribution tools and use self-reported attribution data to find which touchpoints create these signals. They should then partner with revenue leaders to see which signals lead to closed/won sales and help meet ACV goals.

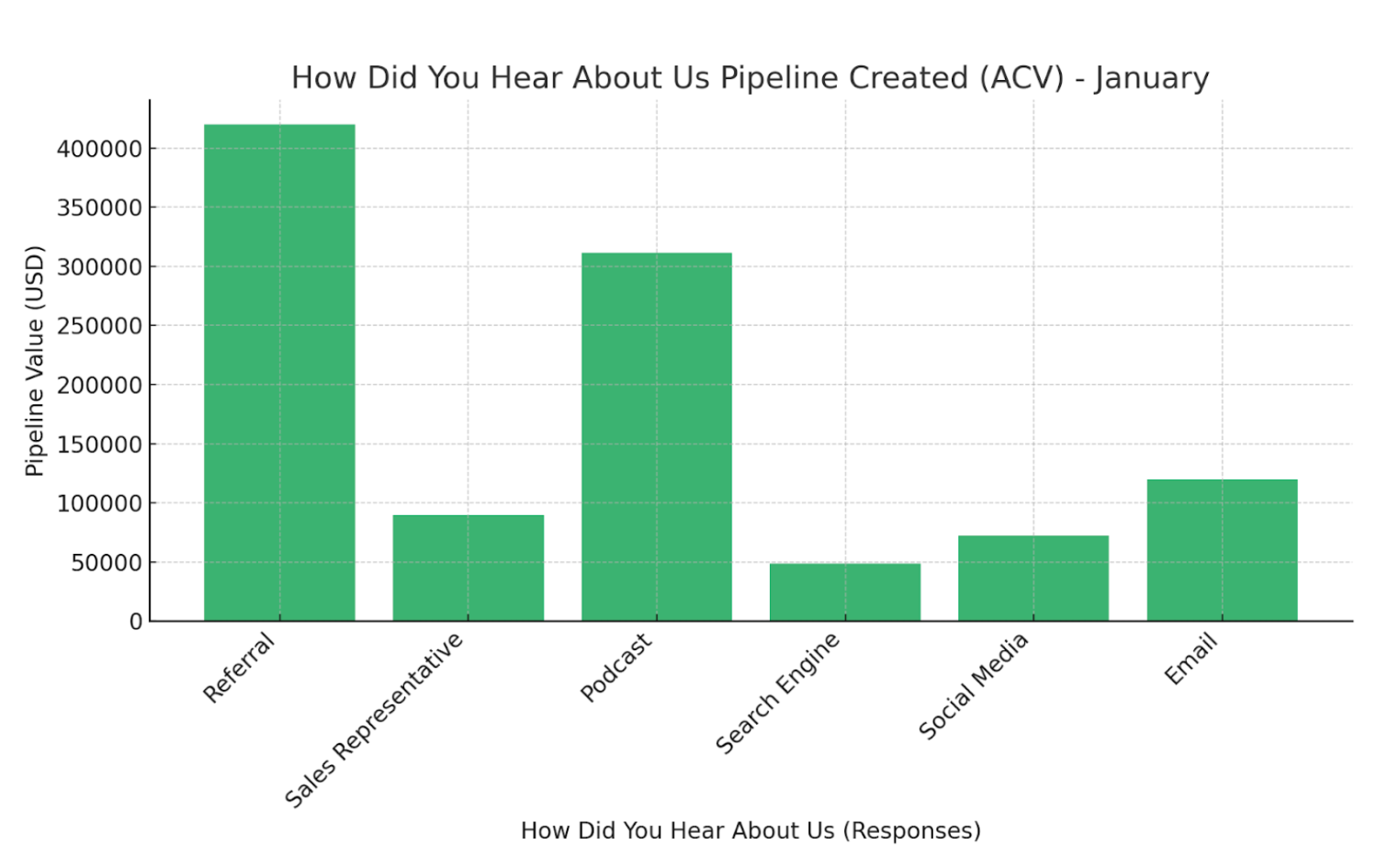

Seeker tip: Create a demand generation and demand capture measurement plan

- Demand Generation: Leverage a self-reported attribution model, such as a “How did you hear about us?” field on website forms or direct questions at trade shows, to uncover which initiatives are driving key intent signals.

- Demand Capture: Use last-touch attribution and attribution software to identify which channels are driving high-converting signals, like demo requests that qualify as MQLs.

Creating a demand generation and demand capture plan balances marketing investments for short-term and long-term growth.

Listen To The Anecdotes

This guide has covered key topics such as marketing attribution, metrics and KPIs, setting SaaS KPIs, aligning sales and marketing, and reporting on intent signals and channels. These insights will help you make informed, data-driven decisions to drive growth for your SaaS organization. However, it’s important to recognize that data doesn’t always tell the full story. As Jeff Bezos once said, “When the data and the anecdotes disagree, the anecdotes are usually right.”

When data and real-world feedback conflict, it’s a signal to revisit how things are being measured. Balancing analytics with real-world context leads to smarter decisions. Data reveals patterns, but anecdotes fill gaps in measurement and add nuance to the story. So, test, learn, and when in doubt, trust your gut.

Keep growing

–Unicorn Seeker Team